[ad_1]

Follow us @crypto for our full protection.

Financial institution of England Governor Andrew Bailey issued a stark warning to these investing in cryptocurrencies: “Purchase them provided that you’re ready to lose all of your cash.”‘

In response to a query about monetary stability, Bailey stated the central financial institution was effectively positioned to answer any threats that may come up. Nonetheless, he objected to using the phrase cryptocurrency and took the chance to push again on their rising reputation.

“I’m afraid crypto and foreign money are two phrases that don’t go collectively for me,” he stated at a press convention Thursday. “They don’t have any intrinsic worth.”

Bailey has lengthy been dismissive of the property, and his feedback comply with yet one more interval of speculative excesses for a market Nouriel Roubini as soon as described because the “mom of all bubbles.”

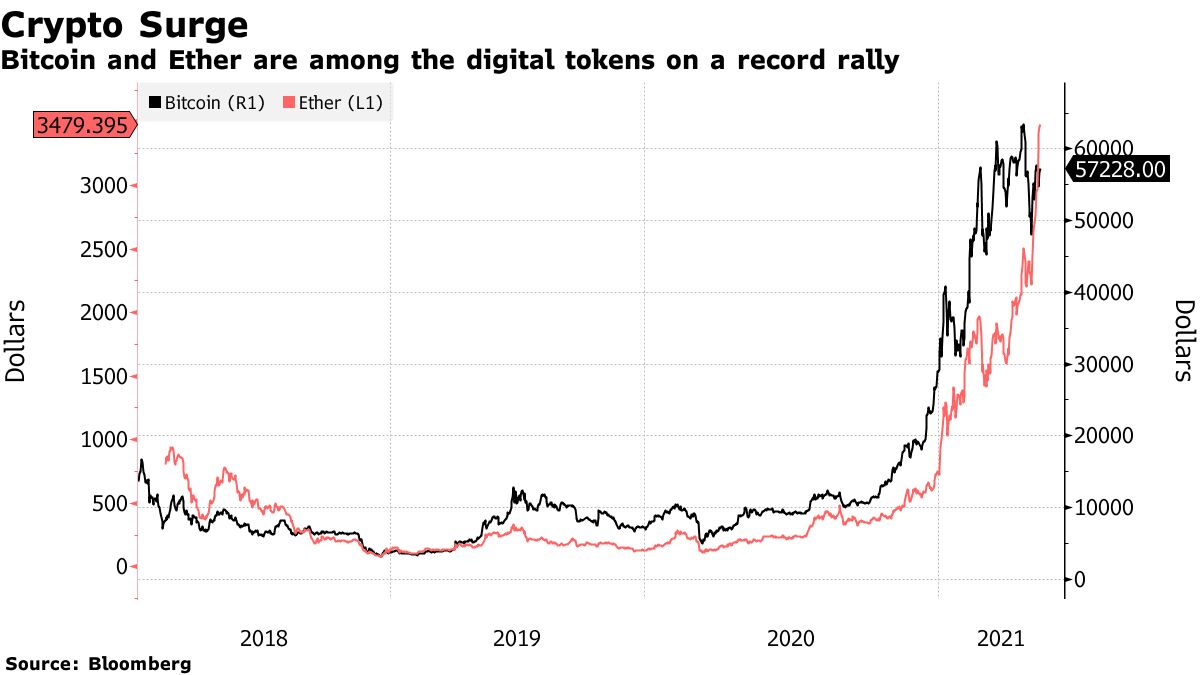

Whereas previously, trillions of {dollars} in stimulus by governments and central banks may need triggered a rush into gold for the inflation-wary and dangerous shares for the intrepid, a deluge of money this time spherical is flooding into the crypto market. It’s even pushed up the worth of digital tokens beforehand thought-about a joke, like Dogecoin.

Read More: Crypto Mania Sends Doge Soaring, Crashes Robinhood Token Trading

The BOE final month stated it will be part of forces with the U.Ok. Treasury to weigh the potential creation of its personal central financial institution digital foreign money, becoming a member of authorities from China to Sweden exploring the subsequent huge step in the way forward for cash. If authorized, the U.Ok.’s digital foreign money would exist alongside money and financial institution deposits, fairly than changing them, they stated.

[ad_2]

Source link