[ad_1]

Follow us @crypto for our full protection.

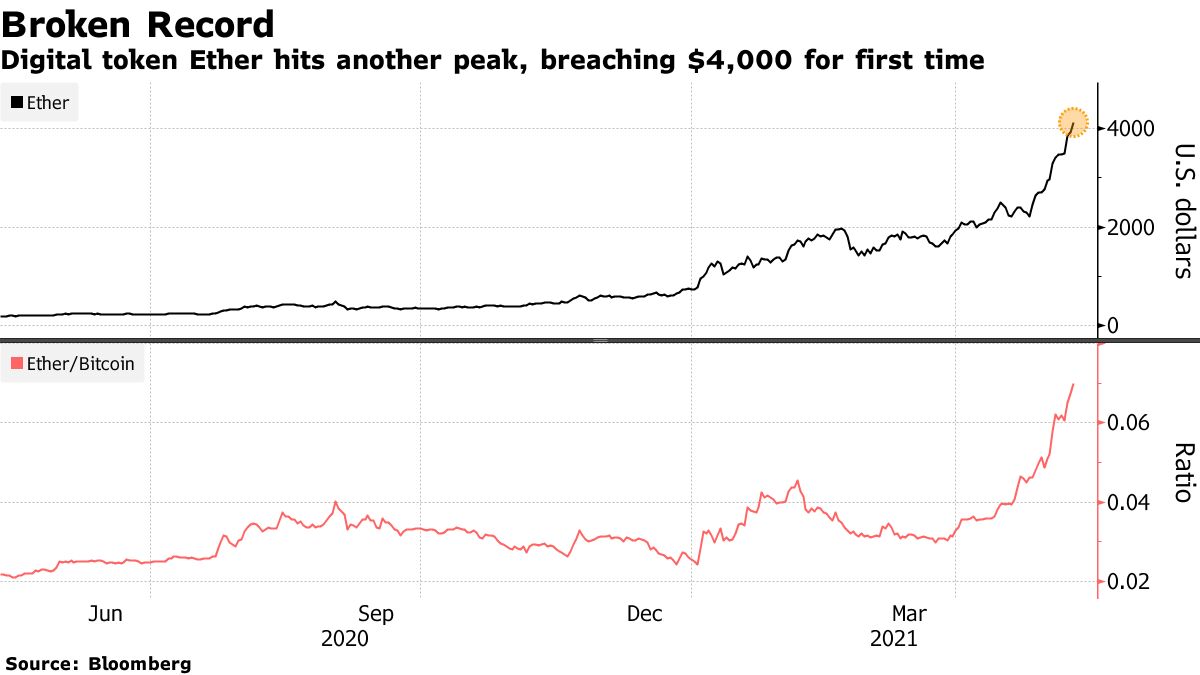

Parabolic jumps in digital tokens reminiscent of Ether, Dogecoin and Binance Coin are outshining Bitcoin, prompting extra questions on whether or not that phase of the cryptocurrency sector is ripe for a reckoning.

The rallies have contributed to a stoop in Bitcoin’s share of the $2.6 trillion crypto market to 43% from about 70% at the beginning of 2021, a metric that for strategists at JPMorgan Chase & Co. and DataTrek Analysis LLC could also be a warning signal of investor extra in a variety of digital tokens.

Bitcoin’s waning dominance carries echoes of “froth” to the extent it’s being fueled “by a rally in different cryptocurrencies pushed extra by retail demand,” a JPMorgan workforce led by Nikolaos Panigirtzoglou wrote in a observe Friday. DataTrek’s co-founder Nicholas Colas has indicated that historical past suggests tokens outdoors Bitcoin can drop “fairly shortly” when Bitcoin’s share hits 40%.

Loads of commentators have been fretting for a while {that a} stimulus-fueled peak is at hand in cryptocurrencies — solely to see them rally much more. However the fear is tough to shake in a sector that defies conventional funding evaluation.

The share of the most important cryptocurrency may very well be declining as a result of traders are getting extra comfy with a wider array of tokens. Alternatively, retail merchants could also be chasing fast, speculative beneficial properties.

“Even in the event you don’t put money into the house, that is price monitoring,” DataTrek’s Colas wrote in a latest observe. He added that with greater than $2 trillion now invested in digital currencies, “a significant reset decrease might additionally have an effect on extra conventional monetary belongings like equities.”

[ad_2]

Source link