[ad_1]

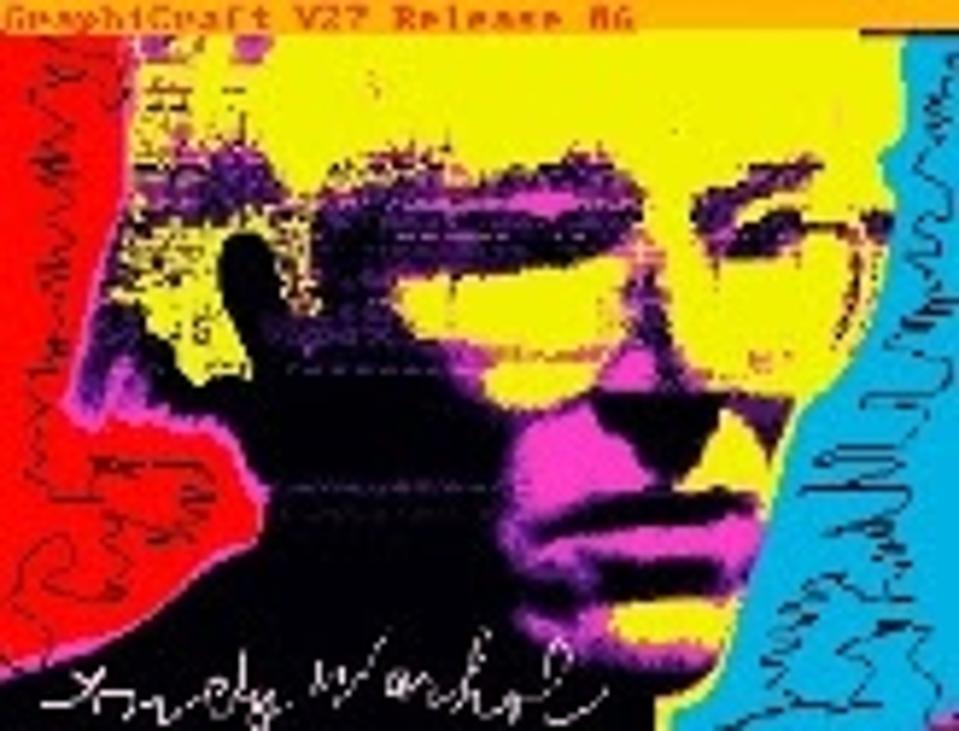

Andy Warhol ‘Untitled (Self-Portrait)’ non-fungible token (tif) 4500 x 6000 pixels (bytes) Executed … [+]

The nascent use of Ethereum to purchase digital artworks as non-fungible tokens dove deeper into uncertainty at this time with the abrupt sell-off of practically each cryptocurrency after China doubled down on its ban on crypto companies for its monetary establishments.

Bitcoin’s worth this morning sank to a low of simply above $30,000, earlier than rebounding to $37,000, amounting to a lack of 12 % for the day. Ethereum and Dogecoin tumbled at about the identical time and are down 27 % and 29 %, respectively.

The intense absurdity of the NFT market — from the $69.3 million sale by Christie’s of a JPG file of a digital photograph collage by South Carolina-based graphic designer Mike Winkelmann, identified to the artwork world as “Beeple”, to Brooklyn-based movie director Alex Ramírez-Mallis’ $85 sale of One Calendar 12 months of Recorded Farts — is rivaled solely by its implicit and deeply-rooted woes.

Compounding the battering by China’s transfer, Ethereum has been pressured into reworking its underlying infrastructure to slash carbon emissions by a hundredfold. Proof-of-work cryptocurrencies have been broadly condemned for being obscenely dangerous to the atmosphere, as a result of every transaction or recording of an paintings requires huge computing energy. Bitcoin, Ethereum, and another proof-of-work cryptocurrencies require gargantuan quantities of vitality, because of the computations wanted for mining. The Bitcoin community consumes as a lot vitality yearly as Argentina. Dogecoin can be a proof-of-work foreign money, but it surely makes use of the scrypt algorithm, which favors high-speed random entry reminiscence over processing energy and can be utilized on much less highly effective computer systems that waste much less electrical energy.

The clamor for NFTs throughout artwork, leisure, and shopper retail industries has ushered in a brand new period of potential fraud and misuse, together with unauthorized creation of NFTs of artists’ works. On-line galleries, corresponding to Nifty Gateway, SuperRare, MakersPlace, Basis, KnownOrigin, and Async Artwork, are proliferating and promoting NFTs for ETH, a frenzy that received’t make a dent on the coffers of gamers with the deepest pockets however leaves many artists questioning if they’ll profit from the burgeoning development. Moreover hypothesis, the market is rife with artistic, usually cynical or comical, makes an attempt to grab any chunk of the bloating share.

Ethereum is an open-source, blockchain-based, decentralized software program platform used for its personal cryptocurrency, Ether. Launched in 2015, the digital token (ETH) shortly ignited into the second-largest cryptocurrency on this planet by market worth after Bitcoin. NFTs are cryptographic belongings with distinctive identification codes and metadata to distinguish every one. In contrast to cryptocurrencies, corresponding to ether and Bitcoin, NFTs can’t be traded or exchanged at equivalency. Cryptocurrencies are an identical fungible tokens used for business transactions rather than conventional paper cash.

“Bitcoin is called a unstable speculative asset, however (yesterday’s) excessive swings unnerved many traders. The collapse in Ethereum was even larger, however that was primarily on account of its outperformance this 12 months (Ethereum YTD +252 % vs Bitcoin’s YTD +33 %),” stated Edward Moya, a senior market analyst for world-leading on-line multi-asset buying and selling companies, foreign money information and analytics supplier OANDA, stated in an e mail interview. “After Bitcoin fell over 50 % from the report highs, the panic promoting ended and plenty of institutional merchants bought again in.”

Celebrated blue chip artists who died lengthy earlier than any such market was imagined be a part of newcomers into this fluid, evolving house.

Andy Warhol ‘Untitled (Self-Portrait)’ Non-fungible token (NFT) 4500 x 6000 pixels (bytes) … [+]

Christie’s introduced yesterday Andy Warhol: Machine Made, a sale of 5 digital works created within the mid-Nineteen Eighties by the Pop Artwork grasp and recovered in 2014 from floppy disks. The unique works which existed solely as digital recordsdata will probably be resurrected as NFTs and provided on the market individually on behalf of The Andy Warhol Basis for the Visible Arts, with all proceeds to profit the non-profit philanthropic basis established by Warhol. Christie’s will settle for fee in Ether or U.S. {dollars}, with a beginning bid of $10,000 for every work in an online-only sale from Could 19- 27.

“The NFT market will take a success from at this time’s cryptocurrency market plunge as many long-term crypto traders simply misplaced a very good share of their wealth, however the long-term outlook nonetheless is upbeat,” Moya stated. “NFTs proceed to attract recent curiosity and are attracting outdated artwork, corresponding to Andy Warhol. At present’s crash was crucial given market positioning, but it surely does not change something concerning rising blockchain demand and rising curiosity in digital belongings.”

Many cryptocurrency consultants have been hesitant to talk particularly about how the crash will impression the usage of ETH for NFT artwork gross sales.

“I can not converse to the dynamics of that market. However usually NFTs are priced in crypto, so a decline in crypto is a web unfavorable for NFTs.” Bankrate.com analyst James Royal stated by way of e mail.

[ad_2]

Source link