[ad_1]

Cryptocurrency is referred to a big selection of technological developments that make the most of a way higher referred to as cryptography. In easy phrases, cryptography is the strategy of defending info by reworking it (i.e. encrypting it) into an unreadable format that may solely be deciphered (or decrypted) by somebody who possesses a secret key. Cryptocurrency is secured by way of this method utilizing an ingenious system of private and non-private digital keys. Nevertheless, no typically accepted definition has been agreed to date. Particularly, World Financial institution has labeled cryptocurrencies as a subset of digital currencies, which is outlined as digital representations of worth which might be denominated in their very own unit of account, distinct from e-money, which is straightforward a digital fee mechanism, representing and denominated in fiat cash. In the meantime, the European Banking Authority has prompt to seek advice from cryptocurrencies as digital currencies, which it defines as digital representations of worth which might be neither issued by a central financial institution or public authority nor essentially to a fiat forex however are utilized by pure or authorized individuals as a method of change and may be transferred, saved or traded electronically[1].

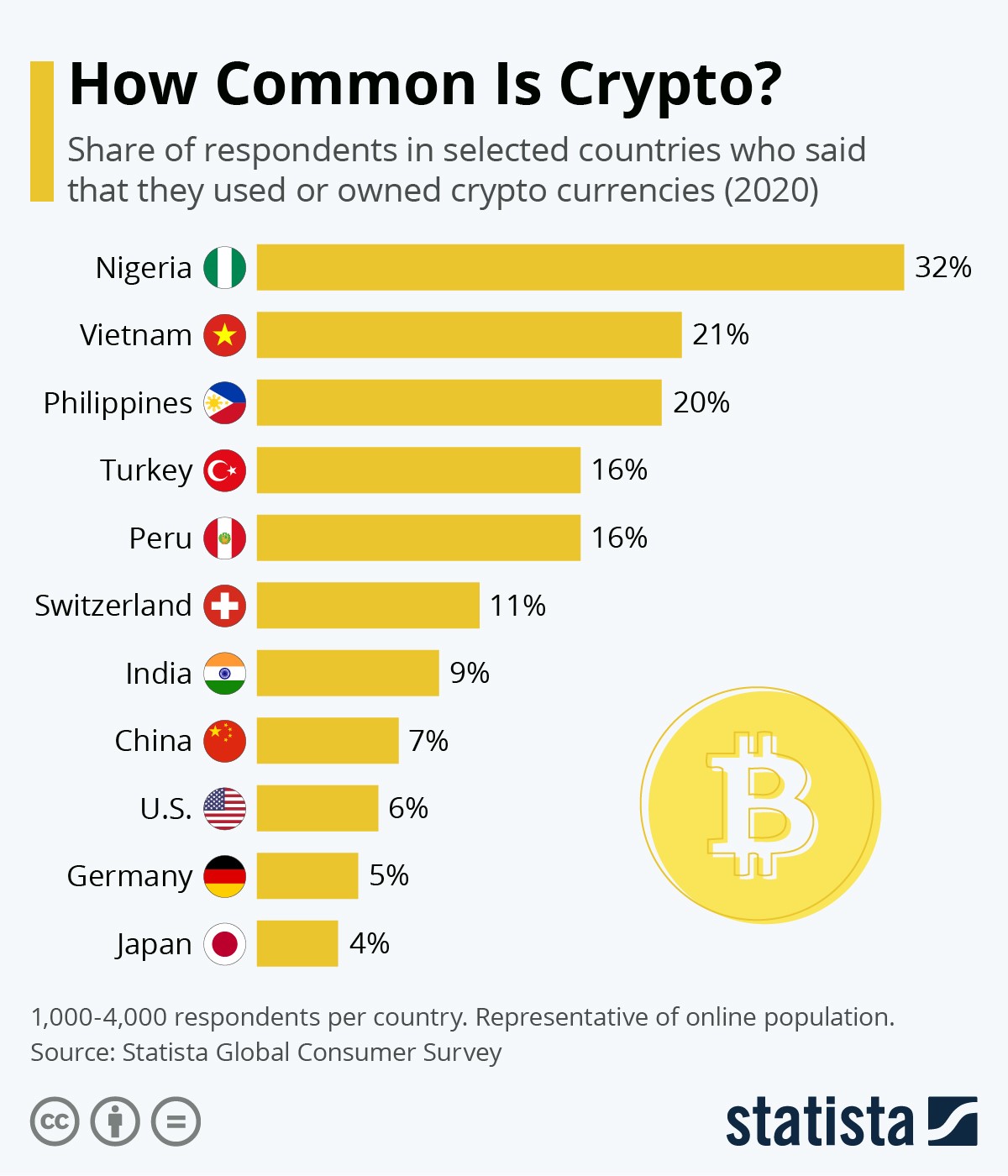

There isn’t a definition of cryptocurrency below the legal guidelines of Vietnam. However, cryptocurrency has been proving its reputation in Vietnam, after a report on survey outcomes launched by Statista, a world supplier of market and client information, says that 21 % of respondents in Vietnam mentioned that they used or owned cryptocurrency in 2020, second after Nigeria (32 %).

Nevertheless, there are some restrictions on the subject of cryptocurrency in Vietnam, most notably, its rules.

Is cryptocurrency thought-about as authorized property or fee instrument in Vietnam?

Below the legal guidelines of Vietnam, cryptocurrency is neither authorized property nor fee devices.

Notably, below Article 105 of the Civil Code 2015, property is outlined as beneath:

1. Property contains objects, cash, invaluable papers and property rights.

2. Property consists of immovable property and movable property. Immovable property and movable property could also be present property or off-plan property”.

Article 17 of the Regulation on the State Financial institution of Vietnam offers that “the State Financial institution of Vietnam is the only real company entitled to situation banknotes and cash of the Socialist Republic of Vietnam. Banknotes and cash issued by the Stale Financial institution of Vietnam are lawful technique of fee on the territory of the Socialist Republic of Vietnam”.

As well as, Article 1 Decree No. 80/2016/ND-CP, amending the Decree No. 101/2012/ND-CP, on non-cash funds offers that “Non-cash fee devices in fee transactions (hereinafter known as fee devices), together with cheques, fee orders, assortment orders, financial institution playing cards and different fee devices as prescribed by the State Financial institution of Vietnam. Unlawful fee devices are fee devices not included in Clause 6 of this Article”.

In apply, the State Financial institution of Vietnam has not, to date, outlined or named the so-called “different fee devices”. Consequently, solely cheques, fee orders, assortment orders, financial institution playing cards or every other fee devices that are named or outlined by the State Financial institution of Vietnam are fee devices. Since cryptocurrency has by no means been named or outlined because the fee instrument by the State Financial institution of Vietnam, it isn’t thought-about as authorized non-cash fee instrument.

Moreover, on twenty first July 2017, the State Financial institution of Vietnam reaffirmed its opinion on the authorized standing of cryptocurrency in Vietnam, when issuing the Dispatch No. 5747/NHNN-PC to the Authorities Workplace in response to a query about Bitcoin, Litecoin, and different digital currencies. Notably, the Dispatch mentioned “As stipulated in Vietnam laws, cryptocurrencies basically, or Bitcoin and Litecoin specifically, aren’t currencies and don’t act as lawful technique of fee”.

Most not too long ago, the State Financial institution of Vietnam issued a directive[2], requesting organizations issuing financial institution playing cards, middleman fee service suppliers, and consultant places of work of overseas banks to oversee, examine and examine card transactions arising at retailers so as to stop, amongst others, card transactions that aren’t in accordance with the provisions of the legal guidelines (referring to prize-winning video games, playing, betting, overseas change enterprise, securities, digital or digital forex…).

What are the dangers related to cryptocurrency buying and selling in Vietnam?

At present, the Authorities of Vietnam has not but issued license to any group wishing to do cryptocurrency enterprise in Vietnam.

In a press convention on financial coverage and banking operations within the first quarter of 2019. Mr. Nghiem Thanh Son, Deputy Director of Fee Division of the State Financial institution of Vietnam verbally affirmed that the State Financial institution of Vietnam has not but issued any license to any firm wishing to do cryptocurrency enterprise in Vietnam.

Working cryptocurrency enterprise has been excluded by Vietnam within the Schedule of WTO Commitments, and within the absence of Vietnamese laws on this type of enterprise, any investor wishing to do cryptocurrency enterprise in Vietnam is requested to seek the advice of with and procure the approval from varied competent authorities in Vietnam, together with Ministry of Planning and Funding, the Ministry of Finance, the State Financial institution of Vietnam; and different related Ministry (if any) in accordance with clause dd, Article 10, Decree 118/2015/ND-CP.

Doing cryptocurrency enterprise in Vietnam with out license shall be topic to administrative sanctions in accordance with the legal guidelines of Vietnam. Particularly, any investor doing cryptocurrency enterprise in Vietnam with out license shall be topic to an administrative penalty of VND50,000,000 to VND100,000,000 and the overseas change operations of the credit score establishment shall be suspended for 3 to 6 months.

As well as, in line with level h, Clause 1, Article 206, Felony Code 2015 (amended and supplemented by Felony Code 2017) on the offense towards rules of regulation on banking operations and banking-related actions, from 1st January 2018, anybody who commits acts together with issuing, supplying or utilizing fee devices inflicting injury to different folks (together with enterprises) from VND100,000,000 to VND300,000,000 shall be fined from VND50,000,000 to VND300,000,000 or imprisoned for six months to a few years.

Any future for cryptocurrency in Vietnam?

Cryptocurrency is revolutionizing the worldwide fee business, by permitting on-line funds to be despatched instantly from one occasion to a different with out going by means of a monetary establishment serving as trusted third occasion to course of digital funds. Backed by an digital fee system primarily based on cryptographic proof as a substitute of belief, it avoids inherent weaknesses of the trust-based mannequin.

Nevertheless, Vietnam appears to take very cautious steps in direction of cryptocurrency as cryptocurrency is alleged to don’t have any authorities supervision and subsequently liable to unlawful actions, corresponding to tax evasion, cash laundering, terrorist funding and hacking, and that cryptocurrency may possess the capability to destabilize present monetary methods which may have an effect on the nation’s financial system.

Whereas cryptocurrency buying and selling and use are booming globally by way of reputation, Vietnam cannot stand outdoors the sport, and one of the latest actions in response to cryptocurrency is that the Ministry of Finance established a analysis group on March 30, 2021, led by Mr. Pham Hong Son, Vice-Chairman of State Securities Fee, to conduct an in-depth research of cryptocurrency, with a view to reaching legislative reform for the business within the nation.

In apply, the present transition of Vietnam’s financial system affords a very favorable context for cryptocurrency, when non-cash fee has been more and more with many apps, QR codes, and e-wallets corresponding to Moca, Momo, or ZaloPay. The analysis on cryptocurrency appears to be backed by the Directive No. 22/CT-TTg dated Might 26, 2020 determining measures to speed up the implementation of a scheme on improvement of non-cash fee in Viet Nam, after 5 years of implementing the Resolution No. 2545/QD-TTg dated 30 December 2016, approving a scheme on improvement of non-cash fee for the interval of 2016-2020 with an bold objective of slashing the ratio of money to complete fee devices to beneath 10%.

Even with latest lively responses, by the Authorities of Vietnam, to the booming of cryptocurrency in Vietnam, the way forward for cryptocurrency just isn’t safe and dependable within the nation till regulatory frameworks are put in place.

[ad_2]

Source link