[ad_1]

The U.S. Inside Income Service (IRS) has modified the crypto query requested on the principle U.S. tax type. Decreasing the scope of the query, the IRS now focuses on taxable cryptocurrency transactions.

New Crypto Query on Tax Type 1040

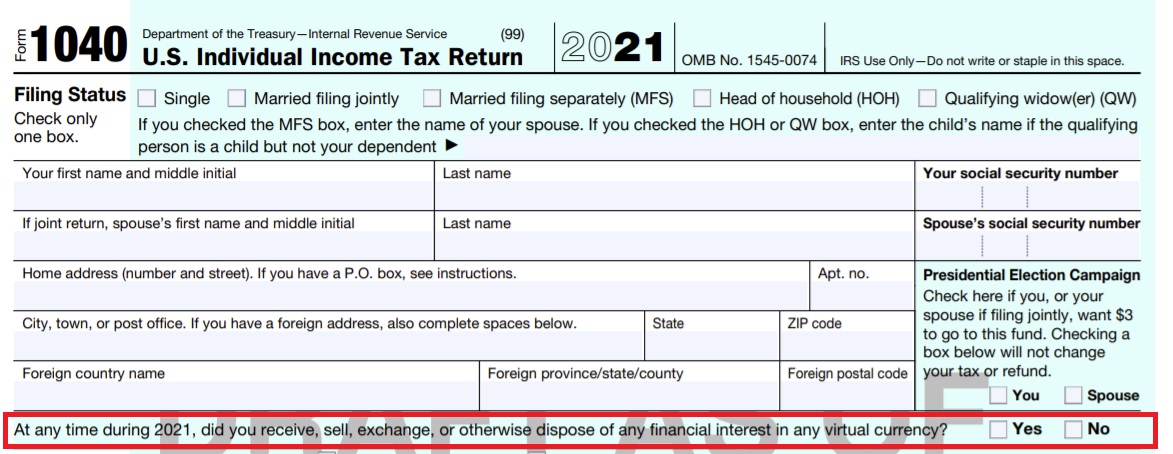

The IRS printed a draft Type 1040 for the tax yr 2021 Thursday. Type 1040 is the principle tax type used for submitting particular person revenue tax returns within the U.S. The draft type exhibits that the tax company has modified the crypto query barely.

The crypto query now reads: “At any time throughout 2021, did you obtain, promote, alternate, or in any other case eliminate any monetary curiosity in any digital forex?”

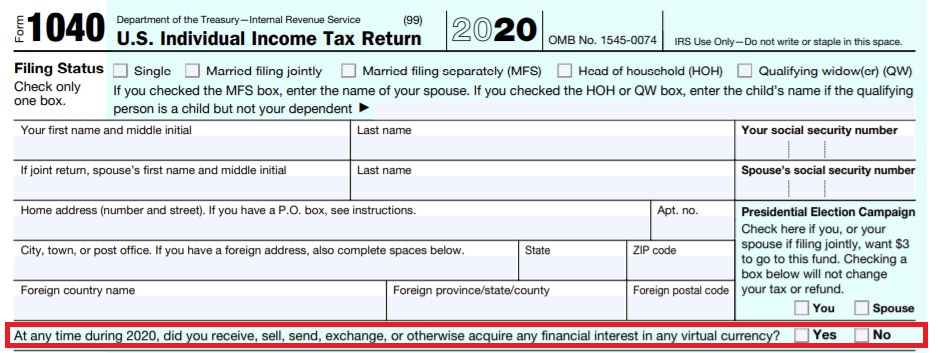

Beforehand, the query learn: “At any time throughout 2020, did you obtain, promote, ship, alternate, or in any other case purchase any monetary curiosity in any digital forex?”

For the yr 2021, the IRS has eliminated the phrase “ship” and changed “purchase” with “disposed of.”

Shehan Chandrasekera, Head of Tax Technique at tax software program firm Cointracker, defined that “The revised query solely inquires about your taxable transactions in comparison with the a lot broader scope of the 2020 model.”

He opined, “Though these modifications don’t have any massive influence in your taxes, it hints at what the IRS has discovered from the 2020 model and the route it’s heading,” elaborating:

Underneath the revised query, you don’t should examine ‘Sure’ for those who ship cryptocurrency in between wallets/exchanges or purchase them, that are each non-taxable transactions.

What do you concentrate on the brand new crypto query on the tax type? Tell us within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any injury or loss induced or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link